More subs, higher prices, more advertising, and reduced headcount puts Spotify in the black…

By Paul Marszalek

By Paul Marszalek

TheTop22.com

Spotify had a heckuva third quarter, posting a roughly $35m profit.

Technically, the company isn’t profitable, it’s cash flow positive. To be profitable, it would need to have paid off development costs and debt. But hey, a win is a win. Cash flow positive is a good thing – particularly when Spotify forecast a loss of almost $50m.

How did they do it? Volume!

The streamer added premium users, monthly users, higher subscription fees, and ad revenue. It subtracted 200 jobs.

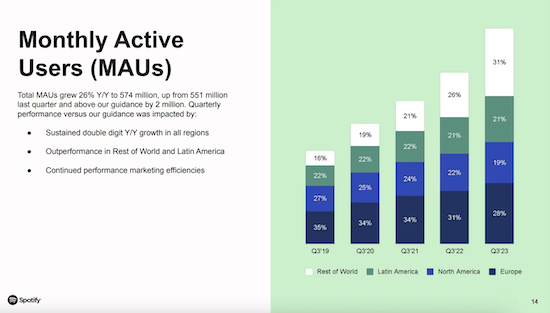

Premium subscriber growth, fueled by North America and Latin America (and related price increases), moved the needle to $3.1 billion — a 16% increase over Q3 2022. Spotify now boasts 226 million paying subscribers among their 574 million monthly users.

Ad revenue was up as well, to roughly $487m — a 24% increase.

The numbers are great all around, with just a couple of exceptions: The “profit” came as the streamer managed to cut operating costs by 8% — more than $125 million year over year. Much of this came from shedding a total of 700 jobs over the period — 500 in January, and another 200 in June.

Further, the ARPU (average revenue per user) slid 1%. This is going to be a lousy metric for Spotify in the near term as most new users are coming from markets that simply don’t pay as well as Europe, North America, and Latin America. In short, almost every new user Spotify adds is a less profitable customer.

That said, if you’re a long-game thinker, there’s a lot to like in the report.

Following the earnings call, Spotify founder Daniel Ek promptly sold $64m worth of stock, so at least someone is making money.

-The Top 22 – Triple A, Indie, Alternative Rock

-The Top 22 – Triple A, Indie, Alternative Rock